If you want to contact Nationwide UK customer service number, you don’t need to spend hours on finding the direct numbers of their representatives. Here, You will find all direct numbers of different departments of the company and also their local UK postal address.

Picture from https://www.facebook.com/NationwideBuildingSociety/photos

Nationwide Building Society is a British mutual financial institution based in the United Kingdom and is the world’s largest building society in the world. Nationwide UK is the second largest provider of household savings and mortgages in the UK. Through its more than 700 branches across the country, the organization provides convenient fiscal and banking services including current account services to the customers.

You can read about their services and get more detailed information by visiting their official website.

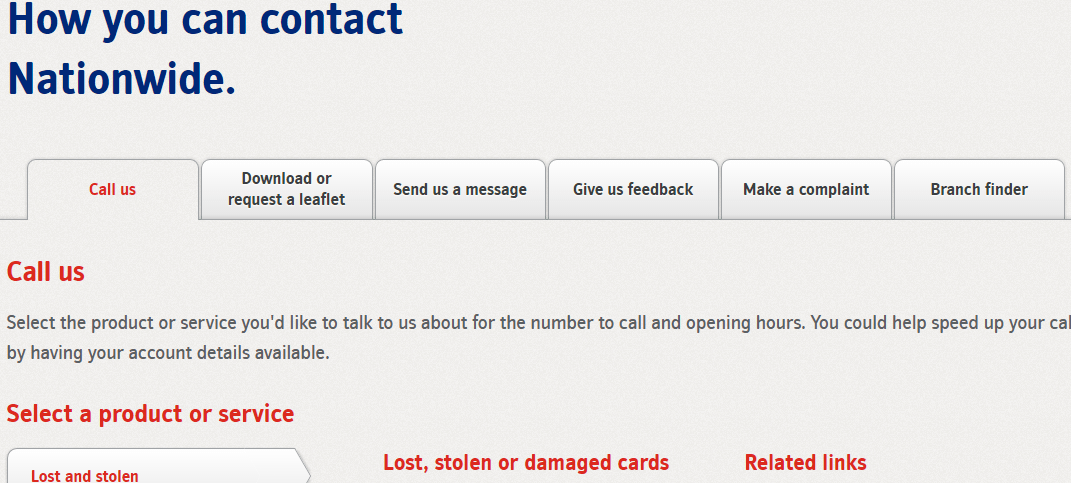

Nationwide Customer Service Phone Numbers

[wpsm_comparison_table id=”24″ class=””]

A Brief About Nationwide UK

History: The history of Nationwide UK dates back to 1848. It got its current name “Nationwide Building Society” by the Co-operative Permanent, based in New Oxford House in the London Borough of Camden in the year 1970. The name reflects that the organization has coverage throughout the nation. It launched online banking service on 27th May 1997. On 28t August 2007, Nationwide completed a merger with Portman Building Society. At that time, this mutual body possessed the assets of over £160 billion and around 13 million members. Current Chief Executive of the company is Joe Garner, who was appointed on 5 April 2016.

Products & Services: through around 700 branches, the Nationwide UK offers direct financial services to its customers. It is a major provider of mortgage loans and savings, along with loans, credit cards, bank accounts, and insurance products.

Financial Performance: For the 2015/2016 Preliminary Results (April 2015–April 2016), underlying profits were up 9% to £1.337 billion, while statutory profits rose by 23% to £1.279 billion. In the last fiscal year, the Nationwide UK had the assets of £208.9 billion, while the whole building society institutes in the UK has total assets of £331 billion. The company helped 57, 200 people buy their first home.

Ways to Contact Nationwide UK Customer Service

When the customers are unhappy, they listen and act accordingly to put the things right. You can select among their multiple communication channels to get the assistance of Nationwide customer service Number.

- Visit their Contact Us page on Nationwide UK official website

- Call on Nationwide contact numbers, given above

- Download mobile app

- Use Live Chat

- Submit online complaint form

- Find the nearest branch

- Write a letter and send by mail

- Post handwritten letter to their postal address

- Fax

- Connect via Social Media

You can even provide the feedback for their services, products, and experience with Nationwide customer service. Regardless of your contact choice, the organization makes sure that you receive expected and polite assistance from their representatives.

Nationwide UK Customer Service Address

You can write your complex queries, which cannot be resolved on the phone, by writing a letter and sending it to their postal address:

The Complaints Team, Nationwide Building Society,

NW 2020,

Swindon,

SN38 1NW

Giving the right information will help you get a quick and helpful response.

Nationwide UK Contact Numbers

Every customer is family for Nationwide. When you call to the customer care team, the company’s representatives will speak to you. Your request is forwarded to the concerned department according to your needs and type of information you need.

Nationwide UK customer service phone number helps the clients with following:

- Lost and stolen credit cards

- Emergency and claims

- Current Accounts

- Savings and ISAs

- Mortgage

- Personal Loans

- Insurance Products

- Financial Planning

- Complaints and feedback

The primary Nationwide customer service number is 0800 055 66 22. You will speak directly to their customer care agent and get quick responses to all your queries. Keep your account details and credit cards with you while making the call to avoid inconvenience.

Lost, Stolen or Damaged Cards

Picture from https://www.facebook.com/NationwideBuildingSociety/photos

In case, your credit card gets lost or stolen; it is important to contact Nationwide immediately to report it. You can also contact them for your damaged credit cards. A damaged card is replaced with a new one. For FlexAccount, FlexOne, FlexStudent, FlexBasic and savings, dial the Nationwide credit card number 0800 30 20 11, which operates 24 hours a day and seven days a week.

If you are using the FlexDirect, reach them at 0800 35 73 57, which also remains open 24 hours a day and seven days a week.

For FlexPlus customers, the Nationwide hotline 0800 11 88 55 is open 24 hours a day and seven days a week.

For stolen, lost or damaged credit card, call at Nationwide toll-free number 0800 055 66 22. The company protects you from misuse of your cards. You will also find Nationwide insurance customer service number here.

Opening Current New Account

If you want to open a current account and looking for a profitable bank option, go no further Nationwide. You can enjoy customer rewards and all the best features that a bank can provide to its best. You can call at 0800 30 20 10 for opening a new current account with Nationwide.

This is not for FlexOne and joint FlexPlus accounts. The line is open from Monday to Friday between 8: am to 8:00 pm and on Saturday from 9:00 am to 5:00 pm. The bank remains closed on Sundays and Holidays.

Existing Current Account

Do you already have an account with the Nationwide? Then you have different helpline numbers. Customers of FlexAccount, FlexStudent, FlexOne and FlexBasic, can make enquiries at Nationwide UK customer service phone number 0800 30 20 11.

FlexPlus customers have to dial 0800 11 88 55, and FlexDirect customers have to dial 0800 35 73 57 for getting in touch with a customer service agents. These lines are open 24 hours a day and 7 days a week.

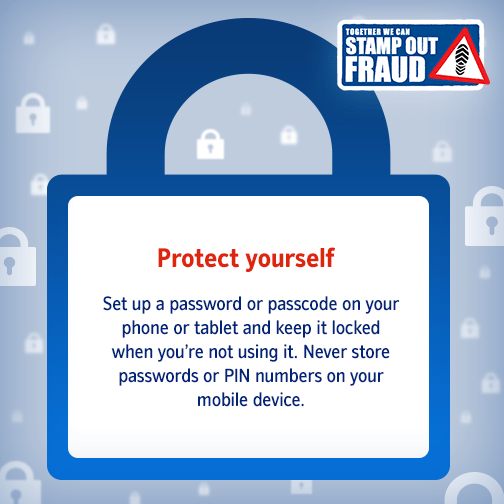

Mortgage and Personal Loans

Getting a personal loan or mortgage is a very important step for you. The process of obtaining a personal loan can be very complicated. Understanding the borrowing process and different types of loan options is extremely important for you.

the Nationwide UK offers mortgage and personal loans for hundreds of needs as the part of their primary services. They have loan specialists who will help you determine the best option for you, your family and your financial situation.

If you are an existing mortgage loan customer, put your enquiries at 0800 464 30 00, and you can track your application status using the same helpline. The line is open from Monday to Friday between 8:00 am to 6:00 pm. If you are a first-time buyer, make dial 0800 121 69 49 for talking to Nationwide customer service agent directly.

Travel Insurance

Picture from https://www.facebook.com/NationwideBuildingSociety/photos

Although travel cover cannot avoid misfortunes during your journey, it can console it in the form of monetary compensation. If you are planning a trip and interested in Nationwide’s travel cover product, make a call at their general enquiry number 0800 055 66 22.

For information on FlexPlus and FlexAccount travel cover, call at 0800 051 01 64, which is usually open from Monday to Friday between 8:00 am to 9:00 pm, on Saturday from 9:00 am to 5:00 pm and on Sunday from 10:00 am to 5:00 pm.

Home Insurance

Picture from https://www.facebook.com/NationwideBuildingSociety/photos

One of the biggest benefits of home insurance is that it saves your massive investment in your home construction. Though this insurance cover will not bring back all the lost things and memories attached to your home, it protects you from unbearable monetary loss.

For getting guidance on home insurance, all you need to do is to contact Nationwide toll-free number 0800 141 21 62.

Life Insurance

Picture from https://www.facebook.com/NationwideBuildingSociety/photos

Life insurance secures your loved ones when you are gone. Not only does life insurance covers unexpected final expenses, but it also provides your family with a financial safety and serves as an inheritance. Call at 0370 010 4080 for general enquiries related to life insurance policies available at Nationwide.

Car Insurance

Picture from https://www.facebook.com/NationwideBuildingSociety/photos

A good car insurance policy protects you from loss of car or damage to your car. It is also a requirement by law. If you drive a car, you must have car insurance. For general enquiries except claims regarding car insurance, reach Nationwide customer service at 0800 028 56 88, which operates from Monday to Friday between 8:00 am to 9:00 pm, on Saturday between 8:00 am to 5:00 pm and on Sunday between 9:00 am to 5:00 pm.

Complaints & Suggestions

Nationwide UK customer service can be reached directly by the numbers given on this page. Customers are precious to Nationwide. They have a team of highly dedicated and well-behaving customer support agent who make guaranteed customer satisfaction possible.

All your complaints and suggestions are accepted warmly. You can lodge complaints and make suggestions about all accounts, personal loans, the mortgage work, credit cards, UCB home loans, Payment Protection Insurance (PPI) by calling at general enquiry number at 0800 30 20 15 from your landline or 03457 30 20 15 from your mobile phones. You can also reach Nationwide insurance customer service at the same number.

Contact Nationwide on Social Media

Picture from https://www.facebook.com/NationwideBuildingSociety/photos

Get in touch with the Nationwide UK customer service through their social media channels:

Write your complaints, suggestions, and experience with the Nationwide customer care service.

Nationwide FAQs

Popular FAQs

- I’ve Forgotten My Customer Number. What Should I Do?

You can easily find your customer number by using the customer number lookup tool. You’ll need your card reader and card to hand.

You can also find your customer number in the banking app. Just log in to your app and go to the menu in the top right corner. Tap ‘Details & Settings’ and then tap on ‘Your details’ to see your customer details.

- My Card Reader Isn’t Working. What Should I Do?

There are many solutions to this problem.

You can use someone else’s card reader provided it accepts your debit card. It is equally secure and safe.

Try changing the batteries of your card reader.

If you still need a new card reader, fill in the online form or visit the nearby branch, they will send you a new card reader within 5 working days, free of charge.

You can still log in to your Internet Bank without a reader, using your 6-digit passnumber and your memorable data.

- How Do I Report A Lost Or Stolen Card?

If your card is lost or stolen, get in touch with Nationwide as soon as possible. You can call them to report a lost or stolen card; the lines are open 24/7. All the contact numbers are given in the table above.

You can also report in the banking app. Open the app and go to the menu. Choose ‘Lost or Stolen Cards’ and then select the card that’s lost or stolen.

- I’ve Forgotten My Memorable Data. What Should I Do?

The company can’t remind you of your memorable data for security reasons, so you’ll have to reset it. You can reset the memorable data in the internet bank or by re-registering. For resetting the data in internet bank, log in to the internet bank using your card reader. Click the ‘Manage’ tab at the top of the page. Go to ‘My security’ and click ‘View or change my security settings.’ Find ‘My memorable data’ and then click on the ‘Change’ link to update your data. If you want to re-register for internet banking, you can visit the website and simply follow the instructions.

Current Account – Contactless FAQs

- How Can I Get A Contactless Card?

A contactless card is available on FlexBasic, FlexAccount, FlexOne, FlexDirect, FLexPlus, FlexStudent and FlexGraduate current accounts and all credit card accounts. The company will issue you with a contactless-enabled card when your current card needs to be replaced. If your card is lost or stolen, you’ll get a contactless-enabled card.

You can also request a card sooner by visiting a nearby branch, through internet bank, or by calling the company.

- Where Can I Make A Contactless Payment?

Look for a contactless symbol. Any retailer who displays the symbol will accept contactless payment.

- Can I Use My Contactless Card To Get Cash Out Of An ATM?

No, you cannot use this card to get cash out of an ATM. You’ll need your card and PIN as usual.

- Will I Receive Cash Back If I Use Contactless To Make A Transaction?

If you use the contactless feature on your credit card, all transactions that earn you cash reward when a PIN and Chip transaction will still do so, when you use the contactless feature.

- Is There A Limit On The Purchases I Make With My Contactless Card?

You can use your contactless card to pay for items up to the value of £30. You’ll need to enter your PIN to make purchases over £30. However, the limit of £30 may vary outside the country.

- Are There Any Charges For Paying With Contactless?

No, there are no additional fees for using contactless. However, standard charges and fees may apply by third parties for the use of your card.

- Do I Receive A Receipt For My Transaction?

You can ask the retailer if you’d like a receipt to confirm the contactless transaction. However, in some circumstances, they may not be able to provide you with the receipt.

- If I Have More Than One Card In My Wallet, Which One Will Be Used If I Tap My Wallet To The Reader?

It may be possible that when you tap a wallet to the reader, the wrong card gets debited. Also, a red light will be shown on the reader if more than the card is placed on the reader. So, it’s advised to take out your contactless card out of the wallet to make the payment.

- Can The Contactless Card Be Used In Abroad?

Yes, you can use the contactless card outside the UK provided there is a contactless symbol displayed there.

- Is Contactless Technology Secure?

Yes, Contactless is as secure as Chip and PIN as it uses the latest encryption technology. The maximum amount of £30 is allowed per transaction. Also, you’ll be asked to enter your PIN from time to time, to verify that you are a genuine card holder.

- Could I Unknowingly Make A Transaction As I Walk Past A Card Reader?

No, your card has to be held close to the reader for longer than half a second. Also, the retailer must have entered the amount to approve first.

- Could My Card Details Be Intercepted During A Transaction?

No, it is extremely difficult for any details to be intercepted while the card is in use as contactless only works when a card is held close to the reader. Also, card reader contains security technology based on industry-wide standard.

- Is It Possible That Payment May Be Taken Twice From My Account?

Not until the retailer asks you to transact twice. The card readers can make only one transaction at a time.

- Is My Payment Information Secure?

The contactless technology is based on secure chip technology, which provides both transaction security and data protection via the use of the latest encryption technology.

- If My Card Is Lost, Can The Person That Finds It Use It Repeatedly?

If someone makes various payments in a row, they’ll be prompted to enter the card’s PIN for security reasons. Furthermore, they cannot make the payment above £30, and if they try, they’ll be asked to make the PIN or Chip payment instead.

So, if you’ve lost your card, let the company know immediately. They’ll cancel the current card and replace it for you.

Current Account – Apple Pay FAQs

- How Can I Choose Which Card I Want To Make A Payment With?

The first card added to the wallet app will be your default card. This card will be automatically used if you use one-touch payment. If you want to select one of your other cards, this can be easily done.

In-store payment: With iPhone, open the wallet app. Present the device to the terminal and select the card and use your passcode or touch ID to authorize the payment.

If you want to make the payment through Apple watch, double-click the side button, swipe right or left to select the card and present your watch to the terminal.

In-app and online: You can check out the usual way, tap the Apple Pay logo. Then, tap ‘Cards and Billing’ and select the card. Authorize the payment using Touch ID or your passcode.

- Can My Family Members Make Payments Through Apple Pay Without Me Knowing?

Yes, if they know your handset passcode or have their fingerprint registered. To avoid this, you must keep the passcode private and remove their fingerprint. Or, you can also delete the credit/debit card set up on Apple Pay from any shared devices used by your family.

- How Can I Request A Refund Following An Online And In-App Transaction?

The merchant will process your refund in the same way as it is for any online purchase. However, it may take some days for the refund to appear in your statement, which depends on the refund and return policies of the merchant.

- Why Can’t I Get A 6-Digit Verification Code Over The Phone?

The verification code is sent automatically by a system which uses customer’s contact details. If you are having difficulty, you can call the in-app number for support.

- Why My Transaction Was Declined While Making An In-Store Payment?

This could be due to the faults on merchant’s end, or there could be a problem with your account. If you think payment should have gone through, call the company, and they’ll check your account.

- What To Do When The Device Is Broken, Lost Or Stolen?

Use the Find My Phone app or go to the iCloud account to suspend the digital token and erase the data on the device. This will permanently remove the ability to pay with Apple Pay.

You can also give a call to 0800 30 20 11, and the company will deactivate the digital token on the device. As your Touch ID or passcode are required to make the payment, you can add the card to your new device to resume using the service.

2 thoughts on “Nationwide Customer Service Numbers (2018 Updated)”

How to get an account open with Nationwide. How can i proceed? Please suggest the relevant numbers.

My credit card got stolen while i was getting back from work. I tried to contact the bank via email but there was no response. Thanks for sharing these helpful numbers.