Lloyds Bank is a British retail and a commercial bank, which has its branches across England and Wales. This bank is traditionally considered as one of the Big Four clearing banks in the United Kingdom. Here, you can find the most appropriate and helpful Lloyds telephone numbers and the company’s local addresses for related customer service requirements. For more information, you can visit the Lloyds Official Contact Us page.

Lloyds Contact Number List

[wpsm_comparison_table id=”21″ class=”center-table-align”]

Lloyds Bank was established in 1765 at Birmingham. This bank expanded during the nineteenth ad twentieth century and took over a large number of small banking companies. Lloyds Bank is the largest bank in the Britain, and it has an extensive network of ATM and branches in England and Wales.

This bank offers a 24-hour online and telephone banking services in Scotland, Halifax branches in Northern Ireland and many other countries. As in 2012, this bank had 16 million personal customers and small business accounts. Lloyds has its headquarters in London, and other offices are available in Wales and Scotland. They also operate some complexes, headquarters, and data centers in Yorkshire including Leeds, Halifax, and Sheffield.

Lloyds customer care team is highly responsive and is dedicated to answering your each and every query regarding bank accounts, loans, insurances and much more. Regardless all your queries and issues, you can get in touch with the one of the world’s leading bank through the Lloyds customer care number and by their various social media platforms.

Below listed are many ways by which you can get in contact with the Lloyds customer care services:

- Contact Lloyds helpline representatives via landline or mobile.

- Write an email to their mail address and join their mailing list.

- Send a handwritten letter to their main offices.

- Follow their social media channels on Facebook, Twitter, Instagram, and Google+.

- Visit the Lloyds Contact Us page.

For more options available to contact Lloyds customer care service, go to the main site.

Lloyds Customer Service Address

To contact the Lloyds customer care service team, you also have the option to send a handwritten letter to their official postal address:

Lloyds Bank Head Brand Address: 6 Trinity Rd, Halifax HX1 2RG, United Kingdom

Our Recommended Tip: Try to give as much information as much possible about our query and do not write your personal information that can be compromised easily. While writing the letter, remember to be highly detailed and precise about writing your queries or issues.

Some people prefer to call the Lloyds phone number while others prefer to send a handwritten letter to their postal address. Regardless of what contact choice you choose, just remember to give full details about your query.

Lloyds Contact Numbers

All the clients are valuable to Lloyd, and you are always welcomed to call the local Lloyds Helpline and get in touch with their customer care agents regarding any query or issue. When you make the call to the customer care team, your calls get forwarded to the various departments such as accounts, internet banking, loans, mortgages, insurance, investments and much more.

You can also discuss your internet banking, transaction and credit card issues, along with providing feedback on the services provided by the Lloyd.

Lloyds customer care services offer many incredible options such as:

- Account Services

- Banking Services

- Investments

- Loans

- Mortgages

- Online Banking

- Insurance Options

- Credit Cards

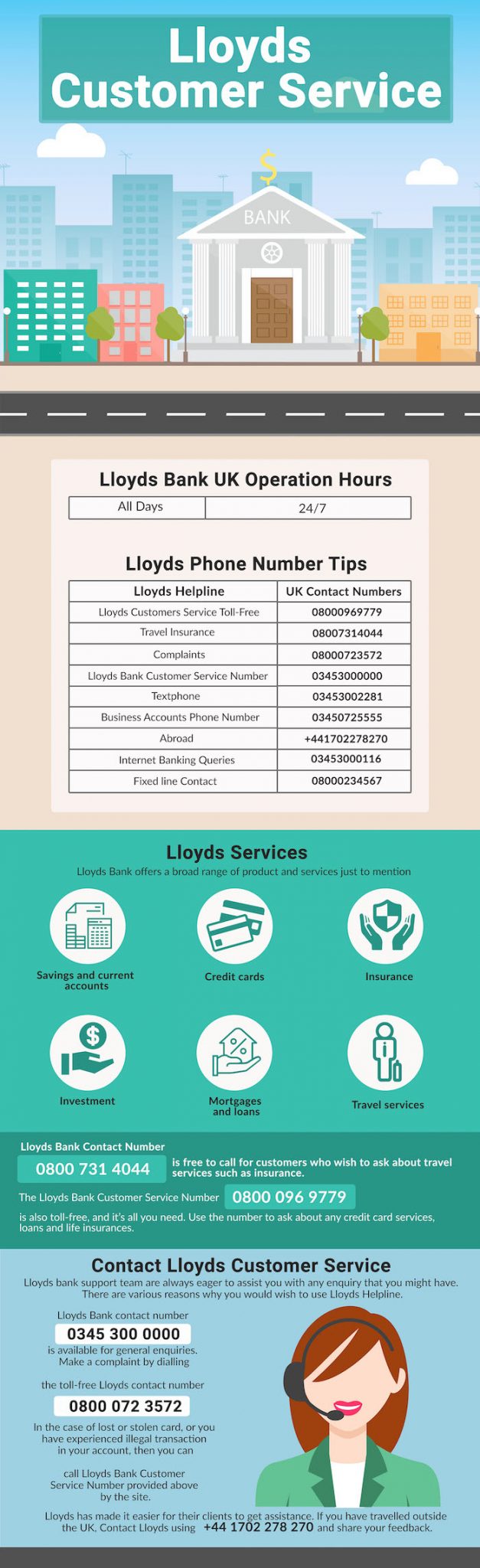

The main Lloyds contact number is 08000969779. You can call this number and directly get in touch with the customer care representatives immediately and discuss all your queries with them. Keep your personal, credit card and account information near you while placing the call, so that your issues gets resolved in no time.

Note:

Calls made to (03) Lloyd’s contact number will be charged at the normal and regular rates. In case, if you are calling from outside the United Kingdom, you will have to pay the additional charges as per the international call rates applied by your telephone service provider. Before making the call, it is always a good idea to consult your telephone service, provider.

Lloyds Services Enquiry

To know more about the Lloyd’s services, you can directly call the Lloyds Helpline number at 08007314044.

The Lloyds customer, care services team, is available 24 hours a day, and seven days a week. Your call will be received by the Lloyds customer care representative with whom you can discuss all your cards, accounts and transaction issues. Keep your account details, personal information near your while placing the call, to avoid any inconveniences during the call. Also, you can leave the feedback for the Lloyds services you use.

The Lloyds Services

The Lloyds offers various kinds of banking services where you can get your savings or current account, take loans, mortgages, get insurance, and make your banking experience easier. To get a new account, credit card, loans or to learn more about the services by Lloyd, dial the Lloyds customer care number, 08000969779.

Current Accounts

There are three kinds of current accounts available with Lloyds, i.e., Classic Account, Club Lloyds. You can easily get a current account with Lloyd, either you can switch your account, or you can upgrade your existing Lloyd bank online.

If you switch to the Lloyds bank, you can transfer everything easily safely and securely within seven working days with the Current Account Switch Service.

For more information about getting a new account with Lloyds, dial this Lloyds customer care number 03453000000.

Benefits of switching to Lloyds:

- Earn up to 15% cashback with regular.

- Get a regular payback on shopping up to the value of £500.

- 2% AER credit interests

Credit Cards

You can easily apply for a Lloyds credit cards by visiting the nearest branch or by dialing this number, 03456062172.

You are only applicable for applying for a Lloyds credit card if you are above 18 and a United Kingdom resident. For a credit card, the minimum balance transfer amount is £100. You can also choose the cards for the purposes you require it like:

- Balance Transfer

- Large Purchase

- Everyday Expenses

- Rewards

- All Cards

For lost or stolen cards, you can dial this Lloyds Helpline number, 08000969779.

To get credit cards, dial this Lloyds customer care number, 08000320444.

For Balance Transfers and other Enquiries, give a call on 03456062172

Loans

You can apply online for a Lloyds bank loan easily if you have held a Lloyd bank account at least for one month and if you are over the age of 18 years.

Lloyd Bank provides you with the graduate loan, personal loan, car loans and debt consolidation loans and much more. This bank also offers you flexibility loan loyalty discounts for our club Lloyds customers.

For more information about the Lloyd bank loans, visit the official Lloyd’s website or give a call on this Lloyd Telephone Numbers 08003898766.

Insurance Options

Lloyd is one of the few leading banks that offer their customers to buy additional insurance, on top of the typical banking. Lloyd provides life insurance, travel insurance, home insurance and much more. They also offer various life insurance and financial protection that covers your family from the accident effects, critical illness or untimely death.

For Life Insurance, dial these Lloyd Telephone Numbers, 08008046826.

For details about the home, and travel insurance, use this number 08007314044.

Use these Lloyds bank contact numbers for claiming your insurances:

- If your policy starts from:

HDA: 03453002289

HAP: 03453005177

HIA: 03453000130

HOM: 03453000160

MHA: 03453001520

2. In the case of emergency claims, use this Lloyds contact number, 03453000170.

Complaints and General Enquiries

Lloyds customer care team wants to know that if you’re satisfied with their service or if you have some complaints regarding their services. You can call them on their complaints number or visit the nearest Lloyd bank branch to file the complaint.

Before making your complaints, you can also visit the FAQ section of the Lloyd official website.

If your queries are not listed in the FAQ section, then you can give a call at this number, 08000723572 for making complaints or providing the feedback

In case, you have a hearing impairment, you can call using this number, 08000567614.

If your queries are not solved by calling the customer care executives, then you can visit their head office.

Lloyds Bank, Victoria House, Southampton Row, London WC1B 5HR, UK

Contact Lloyd Bank via Social Media

You can also get in touch with the Lloyd Bank customer care service through their various social media channels.

You can also use their various social media channels like Facebook, Twitter, and Linkedin to post and message your grievances. Also, you can follow them on their every social media handle to keep yourself updated with the latest services and loan rates provided by the Bank.

You can also see various insights of the Lloyd bank that they post on their channels via several photos, videos, and forums.

Does Lloyd Bank service providers distress or exhaust you?

Share your experiences of Lloyd Bank customer care services (problem- solving ability, average waiting time, professionalism, the way of talking, behavior, etc.) for the benefit and sake of the other Lloyd bank customers.

Lloyd Bank- Putting Customers at Heart of Design

Lloyd Bank FAQs

Trending FAQs

- I Have Multiple Profiles/User Names. What Should I Do?

You must only have one user ID, which is the same for both business and personal accounts. When submitting your application the system should identify your existing user ID, if this doesn’t happen, don’t proceed with the application and contact the bank on 0345 300 0116.

- I’ve Filled Out The Application For Internet Banking, What Happens Next?

Return the paperwork to the address provided. Once received, the bank will check and approve it, provided that it has been signed in accordance with the existing mandate. Then, you’ll receive the log on details, an authentication card and a card reader. If this takes too long, call the Online Help Desk on 0345 300 0116.

- Why Has The Bank Requested Additional Information?

Some of the reasons why the bank may need your additional information are:

- They do not hold a signature for you.

- Your sign on the form does not match what they have on file for you.

- The form has not been signed per the mandate.

- The details on the form and file didn’t match.

- Your payment controls and access level are unclear.

- The listed accounts are not showing for the business.

You can call their customer support centre to find out more.

- What Can I Do If My Card Reader Isn’t Working?

If you have locked your card reader, follow the steps given below:

- Log on and fill out your details.

- Select ‘unblock card reader.’

- You’ll be prompted to call the bank and provided with a reference number.

If you are still are having functionality problems, give a call on 0345 300 0116, and Lloyd will issue you a new card reader.

- Why Haven’t I Received My New Card-Reader?

Log onto internet banking and click on the Admin drop-down option on the top right-hand side. After that, click on order additional card reader.

- What Can I Do If I Am Locked Out Of My Account?

Try again to log back into your internet banking using your password and user ID. If you’re still experiencing the same problem, follow the reset process online or call the Online Help Desk.

- Why Was My Payment Referred For Further Checks?

You’ll need to call in as advised on the screen if your payment has been referred. The bank’s advisor will take you through additional security to process the payment.

- What Can I Do If I’ve Paid The Wrong Person In Error?

You can call the Banking Help Desk. The bank’s advisor will try to trace the funds and arrange for the funds to be returned to your account. However, this is done on a best endeavor basis.

- Why Has My Online Transaction Not Been Sent?

There are various reasons why your payment may not be sent. Some of the reasons are:

- You’ve exceeded your payment limit.

- A payment has been made in error.

- The beneficiary hasn’t received the funds.

For more information, contact the Online Help Desk.

- What to do if the authentication card hasn’t arrived or has expired?

You can also use your Business Debit Card to log onto Internet Banking.

Alternatively, call the bank and advisor will order a new reader for you.

- How Do I Change My Text Alert Preferences Or Register For Text Alerts?

If you are a registered user for Internet Banking, download the bank’s mobile app to have access to your balance on the move. If you are not registered, you can sign-up for text alerts by calling Bank Help Desk. You can also pause, resume or cancel alerts by calling the same number. The lines are available from 7 am to 8 pm on weekdays and from 9 am to 2 pm on Saturdays.

General FAQs

- How Much Does Internet Banking Cost?

You will not be charged for using Internet Banking Service. However, charges may apply for making transactions and operating your bank account. Also, charges from telecom providers and ISP still apply.

- Can I View Both My Business And Retail Internet Banking Account At The Same Time?

No, you cannot. You need to log on individually to access your business and personal accounts.

- What Products Can I Apply For Online?

You can apply for a business current account, business overdraft, business loan, business credit card, business insurance and mortgages.

- Is There Specific Software That I Need To Log On To Access Online For Business?

No, you can use any web browser with the functionality of Microsoft Internet Explorer v.7.0 or above.

- Can I Access My Business Accounts From Abroad?

Yes, you can, provided you have internet access and your card and card reader.

- How Can I Make A Complaint?

You have to visit the complaints section of the website to register a complaint. You can also ask for a ‘Voicing your concerns’ leaflet in a nearby branch.

Registration FAQs

- How Can I Register For Online For Business?

You will need to fill an online registration form. Fill the form, sign it and post it to the address on the bottom of the form. You’ll receive your welcome pack within 12 days but if you don’t, call on the bank’s Internet Banking Helpdesk.

- I Forgot To Save Or Print The Pre-Populated Application Form. How Can I Get A New Form?

Call the helpdesk on 0345 300 0116 to get a new pre-populated application form.

- How Can I Change My User Access After I’ve Registered?

If you’d like to change the access level of any user, you can do this by filling an ‘Internet User Variation Request’ form by visiting the website. Take a print of this form, complete it and send it to:

Lloyds Bank

Online Helpdesk

PO BOX 800, Tredegar Park, Newport, South Wales

NP108SB

- Can I Close My Internet Banking Account Online?

No, you cannot. You need to call the Helpdesk to close our account.

- Why Can’t I Log In To My Internet Banking?

It may be because you haven’t received your card and card reader yet. If you’ve applied for the card, it should reach you within 5 working days. But, if you still haven’t received, call the banks’ helpdesk.

You may also be entering the wrong the password or User ID. Try resetting your password and User ID.

Functionality FAQs

- How Do I Transfer Amount Between My Accounts?

If you have more than one Lloyds bank account, you can easily transfer money between your accounts. The expandable ‘Make a quick transfer’ tool will display at the top left of ‘Your accounts’ page.

Check for business. A message will appear that confirms the transfer of the funds or gives a reason why your request can’t be carried out.

- How Can I Make Payments To 3rd Parties Or Other Companies?

If you want to pay another person or company, use the ‘Make a payment’ button. You will see the button to the right of each account name on ‘Your accounts’ page. Or, you can also select the ‘payments’ tab on an account’s statement page. From this, you can add a recipient to your list, view pending payments and change or cancel them, and view recipients that you’ve added in the past; make a payment to them or delete them from the list.

- How Can I See My Pending Transactions?

First, you need to log in to Online for Business. You’ll then see the spending transactions by clicking on ‘Pending debit card transactions and cheque being processed’ on your account statement page.

Security FAQs

- Why Do I Need A Card Reader?

A card reader makes the online business banking as secure as possible. It also reduces the risk of a fraud attack.

- Do I Really Need A Card Reader To Make Payments?

Yes, to make a payment to a new beneficiary, you will need to use your card reader for verification. However, to make a payment to an existing beneficiary, you don’t need a card reader. You can simply use the password that you use for login.

- What Is The Respond Function?

The respond key is used for amending or setting up a new beneficiary or a standing order. Just follow the on-screen instructions to generate a passcode.

- How Can I Unlock My Card Reader?

You can unlock the card reader at any nearby branch. You can also call on the Internet Banking helpline. You will then be taken through some security questions to verify your identity. So, make sure you have relevant documentation to proceed with these checks.

- How Do I Retrieve My Username And Reset My Password?

To retrieve your username, go to the log on page and click on ‘Forgotten your User ID?’ You’ll be taken through a few security questions to verify your identity. Once the details have been confirmed, you’ll see your User ID on the screen.

To reset your password, go to the log on page and click on ‘Forgotten password?’ Answer some security questions to verify your identity. Once the details have been confirmed, you can reset your password. You will need your card reader and card for this process.

2 thoughts on “Lloyds Bank Telephone Numbers (2018 Updated)”

I am facing issues with downloading the Netflix app on my mobile. Please suggest me the relevant number for this issue.

Which contact number shall i use, if my internet banking credentials are not working.