HMRC (Her Majesty’s Revenue and Customs) is a non-ministral of the UK’s government. This authority collects tax and payments for public services and also administrates regulatory regimes like the national minimum wage.

You may need to contact them for many reasons like tax collection, filing complaints against defaulters, etc.

On this page, you will find all direct numbers of HMRC UK helpline. You will also find their direct local address for HMRC customer service requirements. For more information, log on to HMRC official website.

List of HMRC UK Important Contact Numbers

[wpsm_comparison_table id=”16″ class=””]

Best time to call: Phone lines are usually less busy Tuesday to Thursday between 8.30am and 10.30am and 2pm to 4pm.

About HMRC UK

Picture from: https://www.facebook.com/HMRC/photos

HMRC UK was established in 2005 by the Commissioners for Revenue and Customs ACT (CRCA) by merging Inland Revenue and Customs and Excise. HMRC is responsible for countless things, starting from tax collection – income tax, corporation tax, inheritance tax, capital gain tax, stamp, land, and petroleum revenue taxes, and environmental taxes. They are also responsible fro tax credits, administrate child benefit, trade statistics, national insurance, enforcement of the National Minimum Wage, recovery of Student Loan repayments, etc.

HMRC UK authority has to make sure that money is available to fund UK’s public services. They administrate government banking services and tax system in the most simple, customer- focused and efficient way.

Ways to Contact HMRC UK Customer Services

If you intend on contacting HMRC for any information, queries, complaints, you can do so in different ways. Choose the best contact way according to your issues and concerned department.

- Fill and submit the online support form.

- Call their helpline number.

- Write them an Email.

- Post a letter to their office address.

- Visit their official Contact Us page.

- Get in touch via Facebook Twitter, LinkedIn, Google+, Instagram.

Browse more options at HMRC’s main website.

HMRC Postal Address

To contact HMRC about any general issue or your queries, you also have the option to post a handwritten letter to their postal address.

HM Revenue and Customs HMRC) Customer service

HMRC FoI Act Team, Room 1C/23,

100 Parliament Street,

London,

SW1A 2BQ

If you choose this communication channel, it’s important to check a few things before sending your letter. Make sure that you have mentioned the right postal address on your letter. Failure to do so might result in sending your message to the wrong recipient or cancellation of the post.

Also, make sure that you give your accurate contact details (your complete name, phone number, and address). HMRC UK customer service department will use this information to send you a response. Top of it, keep the body of letter precise while making sure that it contains all information (query or complaint) that you want to be resolved.

HMRC Contact Numbers

HMRC offers so many options to contact them. You can discuss your related issues, make general enquiries, lodge a complaint, take help with your HMRC account and can even provide feedback for their services. Phoning them is the easiest and suggested way to contact the HMRC UK customer service team. There will be a representative to assist you with your complaint and enquiries. HMRC officials are very quick and polite while solving your issues.

How HMRC Helps you?

You can contact them for:

- Contact DVLA for questions about driving, vehicle tax, and registrations.

- Contact HMRC for questions about tax, including self-assessment and PAYE.

- Retrieve your lost login details or get help using Universal Jobmatch.

- Get help with your passport application and renewals if you’re a British Citizen.

- Get help with student loan applications and grants.

- To report frauds

- Get help with renewing or applying for a British passport if you live overseas.

- Check if you’re paying about the right amount of tax.

- Get advice on tax credits and tell HMRC about changes to your address, job or salary.

- Contact Department for Transport, Maritime and Coastguard Agency or the Vehicle Certification Agency.

- Contact the Child Benefit Office to report a change of circumstance, get your Child Benefit number, or make a general enquiry.

- To claim your State Pension and more.

Every department has a different helpline number. It is suggested contacting general helpline number to save your time.

Important Note: People with hearing or speech impairment can contact HMRC via textphone numbers.

HMRC UK Services

Picture from https://www.facebook.com/pg/HMRC/photos/

Child Benefits

Picture from https://www.facebook.com/pg/HMRC/photos/

A person gets the child benefits if s/he is responsible for taking care of a child under 16, or under 20 if they stay in approved education or training. Only one person gets child benefit for a child. Even if you choose not to get this benefit, it’s advisable to fill in the claim form because it helps you get National Insurance Credits which counts towards your state pension. It also assures that your child is eligible to get National Insurance number when the are 16 years old.

You need to report changes in the child’s circumstances if any. You can also complain if you are not satisfied with the way you have been treated.

To know more about child benefits and guardian allowance, contact HMRC UK helpline number at 03002003100 for enquiries and information update.

HMRC VAT Helpline

VAT is a business tax charged on things like business sales of goods and services, selling business assets, commission, hiring or loaning products to someone, items sold to staff (canteen meals), business goods used for personal reasons, non-sales like part-exchange, gifts, bartering, etc. You can charge VAT only if you are registered for this.

If you are a VAT registered business, report to HMRC the amount of VAT you have paid and the amount you have charged.

To get more information about VAT rates, returns, and registration, you can contact HMRC VAT Helpline number at 03002003700.

National Insurance

People make national insurance contribution to enjoy benefits like State Pension. You are eligible to pay national insurance only if you are:

-

16 or over.

-

An employee earning Euro 155 a week

-

self-employed and making a profit of Euro 5, 965 or more a year.

National Insurance has difference classes and which class you relate to depends on your employment status, our earning and whether you have any gaps in your National Insurance record. You can find your national insurance number on your payslip, on your P60 and letters about your tax or pension.

If you need help with your National Insurance number, record, class, credits and more, contact HMRC UK customer services at 03002003500.

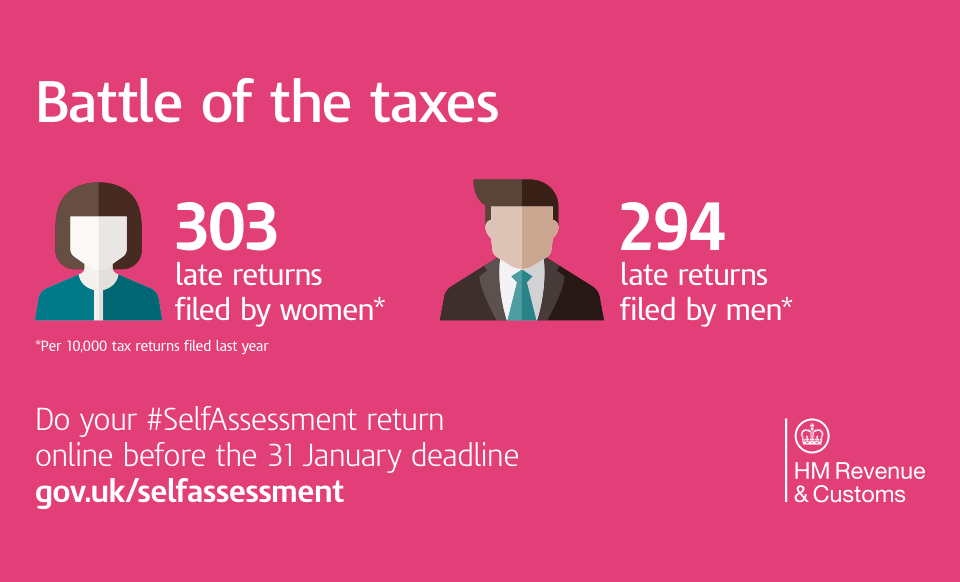

Self Assessment Tax Return

Picture from https://www.facebook.com/pg/HMRC/photos/

Self-assessment is an automatic system for collecting income tax. Tax is automatically deducted from wages, pensions, and savings. People must report their income on their tax return. You need to send a tax return for the last financial year if you were self-employed if you got Euro2, 500 or more untaxed income, your saving were Euro10,000 or more, you were a company director, your income was Euro50, 000 and you claimed child benefits.

You can claim tax relief for donation to charity, private pension contributions and if your work expenses were over Euro2, 500.

If you need help with registering for self-assessment tax return, you can visit HMRC official page or call at their general inquiries number at 03002003310.

Income Tax

Picture from https://www.facebook.com/pg/HMRC/photos/

The tax you pay on your income is called income tax. You pay income tax on things like money earned from employment, profits made from self-employment, benefits from your job, rental income, some state benefits, most pensions, etc.

You can directly contact HMRC UK customer service number at 03453003900 to know about income tax allowance, tax relief and how to pay income tax.

Other Services of HMRC UK Helpline

Service list of HMRC UK is vast. From registration of birth, marriage and death to buying, selling and scraping a vehicle; and from dismission of staff and health and safety at work to UK visa and immigration services, you can contact HMRC customer care for almost any legal issue.

HMRC UK Online Helpdesk

You can contact HMRC UK online helpdesk at 03002003600 to resolve following issues:

-

logging into and registering problems.

-

receiving error messages.

-

trouble submitting forms.

If you are facing technical issues with VAT online services, contact HMRC VAT helpline number at 0300 200 3701.

Contact HMRC UK for Complaints

HMRC takes care of their customers efficiently. However, if you ever feel unhappy with their services due to unreasonable delays, improper call handling, rude behavior, you can lodge a complaint against that particular department or person through HMRC helpline number. You can also do the same by filling our online forms.

HMRC team will do everything to resolve your issues and provide you the best services. Call HMRC toll-free 0800 854 440.

HMRC UK on Social Media

You can stay in touch with HMRC through their social media channels. You can get an immediate response to your queries and complaints by raising your concerns on social media platforms like Facebook, Twitter, Linkedin, etc. Find the detail of HMRC social media accounts:

HMRC FAQs

Registration And Enrollment FAQs

Why I’m having problems logging in?

Your HMRC account will be locked if you enter the wrong user ID or password 3 times or more and you won’t be able to use HMRC Online services for the next 2 hours. Try logging in again after 2 hours.

You can also reset your user ID or password by visiting the company’s official website.

How do I register as an individual?

First, click ‘Register’ in the ‘New user’ section of the login page. Select the services you need to use and enter your name, a password and some details depending on the service you need. After you’ve successfully signed up, a user ID will be displayed on the screen. Make a note this ID as you’ll need this ID every time you log in to use the services. You’ll not get this ID again and won’t get written confirmation of it.

How do I register as an Individual or Organization?

If you are using HM Revenue and Customs online services for the very first time, click “Register” in the ‘New User’ section of the login page. Here, you will be asked to opt for the services you require, enter your name, a password of your choice and some other mandatory details depending on the type of service(s) you choose to sing up.

After completing the above steps rightly, a user ID will be displayed on the screen. Just, take note of this user ID and keep it protected because you will be asked to log in with this unique ID every time you use HMRC online services. This user information will not be displayed again, and you won’t get a written confirmation of it.

The Government Gateway will issue you with an Activation Code for each online service that needs one.

This code will be issued to you within 7 days only after the completion of your enrolment and will be delivered to your mentioned address. You might have to wait for 10 days to receive the Activation Code Letter or for up to 21 days of you live overseas.

After receiving your Activation Code Letter, you must activate the service within 28 days of the date written on the letter you receive. And, if you don’t pay attention to the activation of the service, the code will automatically expire, and you will have to apply for a new one.

Whom should I contact if I don’t receive my activation code letter?

If you have just enrolled yourself for an online service, the Government Gateway will issue you the Activation Code, within 2 days. This Activation Code will be delivered to the address you mentioned for that specific service you require.

In case, if you don’t get your code after 5 days (21 days if you stay abroad), you are recommended to contact the HM Revenue & Customs Online Services Helpdesk.

I am unable to activate my service as my Activation Code is lost/has expired.

HM Revenue and Customs (HMRC) suggest you print off this page for reference purposes.

Lost Activation Code

In case, you have misplaced your Activation Code follow these steps to get a new one.

- Visit the Government Gateway

- Click on the button to enter the Government Gateway

- Log in with your user ID and Password

- Go to your ‘Services list,’ follow the ‘Activate Link’ under ‘Action.’

- Now follow the ‘Request a new Code’ link

Note; If you have lost your Activation Code within 28 days of enrolling for an HMRC online service only then, you will be accountable to request for a new one.

The Government Gateway will issue a new Activation Code within 2 days after you apply for a new one.

It takes up to 5 days to deliver the Activation Code Letter or up to 21 days if you live abroad.

The service must be activated within 28 days of the date mentioned in the letter you receive; otherwise the code will expire, and you will have to request again for a new one.

Expired Activation Code

Simply, request a new Activation Code if your code has expired by following these steps;

- Visit the ‘Welcome to HMRC Online Services’ login page

- Log in using your User ID and Password

- Choose the services for which you want to register and enrol, then enter the requested information.

The Government Gateway will deliver or issues a new Activation Code within 2 days of your request.

It takes over 5 days to get a new Activation Code within 2 days of your request for a new one.

Service must be activated within 28 days because the code will automatically expire after 28 days and then you will have to order a new one.

Why am I not able to activate the service?

It is because of the following 2 reasons;

- You must have entered the wrong code; please enter the right information from the Activation Code Letter

- You might have crossed the 28 days time limit, and your registration has expired; sign up again or register yourself to request a new Activation Code Letter.

If you are still not able to initiate the services, contact HM Revenue and Customs Online Services Helpdesk.

How can I change my User ID or Password?

You can’t change your user ID once you sign up for HMRC online services but you can surely change your password. And, for that, you need to log in with your user ID and password. Click on the box marked ‘Your Account’ and on the left-hand side you will see the option ‘Change Password.’

How to update my contact details?

Keeping your contact details up to date is crucial. HMRC can easily confirm your submission receipt by email, and then you can also receive your passwords online.

If you want to update your contact details, log in to HMRC online services and click on ‘Your Account’ from the main menu on the left. And, if you want to update your email address for confirmation of your submission receipt and new online password select ‘Change Details.’

You can also update your contact details like; email address, phone number, account name and address by selecting ‘Update Personal Details’

Can I still register for HMRC Online Services if I live aboard?

Yes, you can. Overseas residents with a non-UK address can register for HMRC online services. You will have to enroll by entering specific HMRC reference information that verifies you or your organization. You don’t have to enter a UK postcode unless you are signing up as a Corporate Tax Agent or a PAYE Employer.

Once you are done with enrollment to use the online service, you must wait for a confirmation letter containing an Activation Code before you can employ the services. This will take up to 21 days to reach you.

What details are needed for the registration of the Self Assessment Online Service?

Individual Registration

If you are registering as an individual, you are required to enter your UTR (Unique Taxpayer Reference) or National Insurance Number or Your Postcode. You also have the option of selecting ‘living abroad,’ if appropriate.

Your UTR number is written on the Self Assessment tax return or on your Statement of Account. You may also find your UTR on a Notice to complete a Tax Return or on other relevant documents. For more information on UTR, you can also contact your Local Tax Office.

Registering as Trusts and Partnerships

To register for the Self Assessment Online Service as a Trust or Partnership, the Trustee or nominated partners have to enter Trust or Partnership UTR and Postcode.

Registering as an Agent

As an agent, you will be asked to enter your Self Assessment Agent Reference Number and your Postcode. If you don’t have a Self Assessment Agent Number, contact your local tax branch office.

Where can I find the terms and conditions for HMRC Online Services?

You can find the copy of the terms and conditions by clicking on the below link.

You can also find the link at the bottom of the Online Services page that will take you directly to the terms and conditions of HMRC Online Services.

I have previously registered and used the Government Gateway – can I still use it?

Yes, you are free to use the Government Gateway website. Also, you can easily access HMRC online services and ‘change your password,’ if required.

What information is required to sign up for the Stamps Taxes Online Service?

If you are a Limited Company already registered with Companies House, you will need the following;

- Registered Office Post Code

- Companies House Registration Number (CRN)

If you are a Limited Liability Partnership, you will be asked for;

- Partnership’s office postcode

- Partnership’s self-assessment Unique Taxpayer Reference

If you are a Partnership or Trust under Self Assessment, you will require the following;

- Postcode

- Partnership or Trust Unique Taxpayer Reference (UTR)

If you are a Self-Employed under Self Assessment, you will need your

- Postcode

- National Insurance Number

- Self Assessment Unique Taxpayer Reference (UTR)

2 thoughts on “HMRC Telephone Numbers (Updated)”

I wanted to enquire about vehicle and driving tax from a long time. Thanks a ton for providing the appropriate HMRC numbers.

I am interested to know the procedure to apply for a British Passport. Can you give me a relevant number for the enquiry.