Barclaycard UK Phone Number

Barclaycard is a brand that represents a business and retail banking section of Barclays bank. The brand is recognized in the United Kingdom and many countries globally. Barclaycard was one of the first credit cards to be introduced in the United Kingdom. Only two other cards, Diners Club and American Express, were available in the market when Barclaycard was introduced. The brand would then become part of Visa card. However, there exist versions

Only two other cards, Diners Club and American express, were available in the market when Barclaycard was introduced. The brand would then become part of Visa card. However, there exist versions of American Express and MasterCard too. Barclaycard is one of the most recognized cards in the United Kingdom and they make up 20% of all cards issued in the UK.

In this post, you can find the Barclaycard direct contact number and company’s local UK address for related customer service requirements.

For more information about Barclaycard contact details, you can visit the Barclay card Official Contact Us Page.

Barclaycard Phone Number List

[wpsm_comparison_table id=”96″ class=”center-table-align”]

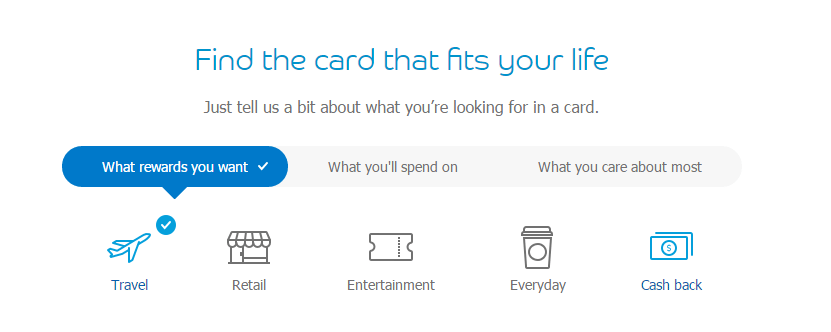

Barclaycard offers a large number of cards to their customers. Customers can choose a card based on your needs and your current financial situation. An initial card is designed for new customers or those who have a limited credit history. There are reward cards, which you can use anywhere and gain points as you use them.

There are several versions of platinum cards. Platinum all-rounder charges absolutely no interest for 20 months on all purchases and balance transfers on the card. Barclaycard has ensured that there are some other options for customers looking for the right Platinum cards. Barclay card gives you a lot of flexibility. You can use your card in many countries around the world that accept the card. You also stand to earn points and rewards, if you learn how to make the most of it. Use the card on your day to day shopping and make a point of collecting points from all the places, where you use the card. Barclaycard has what they refer to as freedom booster partners. You can increase the points you need significantly if you purchase from some of their partners.

Apart from providing the best card services to their customers, Barclaycard also provides exceptional customer services with their expert customer care teams. Regardless of all your issues and queries, you can always get in touch with the Barclaycard customer care representatives through various communication channels.

Ways to Contact Barclaycard

If you face any issues regarding the services provided by Barclaycard, you can contact their representatives by using the several communication mediums provided by the company:

- Contact Barclaycard UK phone number via landline or mobile phone.

- Send a handwritten letter to their postal address.

- Write an email to their mailing address.

- Sign up for their social media channels on Facebook, Twitter, and Google +

- Visit the Barclaycard Contact Us Page.

For more information regarding the Barclaycard contact details, you can visit the main site.

Barclaycard Customer Service Address

If you do not want to contact the Barclaycard customer care representative via email, call and or live chat, you can also contact them by sending a handwritten letter to their postal address:

Barclaycard, 51 Saffron Road, Wigston, LE18 4GA

Tips for writing the Letter:

While writing the letter, try to give as much information as much about your query but not the personal details that can be easily compromised. Write your letter with full details and in a very highly detailed and precise manner.

You also have to mention the following important details to get the best response:

- Personal Information.

- Contact Details

- Card details, and all other necessary details regarding your issue.

Remember to mention the contact information with name, full address and phone number, so that your Barclaycard customer care representatives can contact you with ease.

Barclaycard Services Enquiry

Every client of Barclaycard is valuable and is always welcome to call to Barclay card customer service phone number to get in touch with their agents regarding any query. Your call will be received by the Barclaycard customer care agent who will receive and forward your call to the respective departments such as credit card, travel cards, money transfers and much more.

Barclaycard customer care representatives offer many incredible services such as:

- Credit Cards

- Money Transfer

- Account Assistance

- New Cards

- General Enquiries

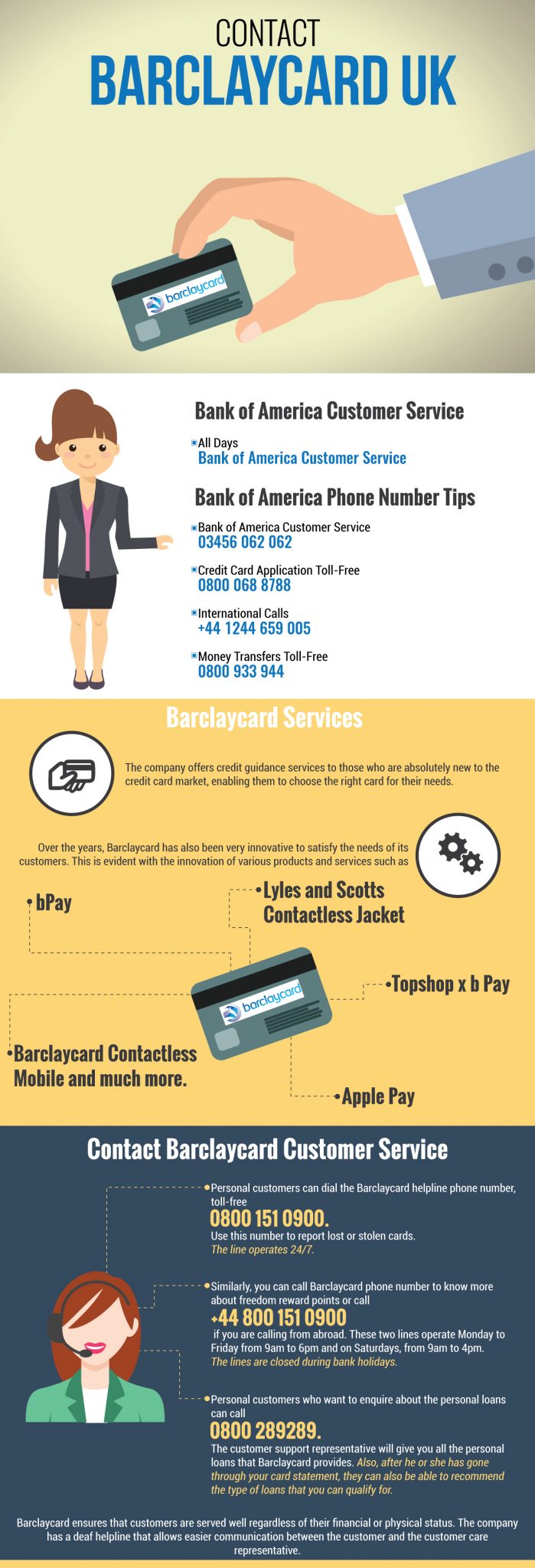

For customer support and inquiries, customers can call Barclaycard Phone Number. There are however a number of Barclaycard Phone Numbers you can use depending on what you are seeking. There is a Barclaycard Phone Number for new customers who want to apply, you can also call this Barclaycard Phone Number 03459454545 in case you lose your card.

If you are not sure the exact Barclaycard Phone Number for your branch, your may call 0800400 100 then select option 3.

You can use the above-mentioned numbers to get in touch with the customer representatives in their working hours.

Note:

Calls made to the (08) Barclaycard phone number UK are free of cost. Calls made to (02) or (03) Barclaycard phone number are charged at 13 pence per minute with the addition to the telephone provider’s access charge.

In case, if you are calling from outside the United Kingdom, you will have to pay the international call rates as applied by your telephone service provider.

We recommend you to call your service provider before making the call.

Barclaycard UK Working Hours

The opening and closing timings of Barclay card customer service phone numbers are:

- 8 am-11 pm, seven days a week.

- The helpline number lines are open seven days a week, 24 hours a day.

Backyard Services Numbers

Barclaycard offers an incredible range of cards services such as travels, retail, entertainment, and all other cards, which can make your banking experience more customized. You can use this Barclaycard UK phone number, 08001510900 to get in touch with their agents regarding your issues.

Advantage Aviator Card

If you enroll with the Advantage Aviator Card, you can earn 40,000 bonus miles.

You also earn two cross miles, $95 as an annual fee, and first checked bag free. Also, 10% of your miles will be returned in one calendar year. With this card, you also don’t have to pay the foreign transaction fees when you make a purchase outside U.S. You are also covered with the benefits such as Extended Warranty, Purchase Security, Price Protection, and Return Protection.

If you face any issues in getting enrolled for this card, you can use this Barclaycard UK phone number, 08001510900.

Barclaycard Cash MasterCard

If you enroll for a Barclaycard cash forward MasterCard, you get a $100 cash reward, you earn 1.5% cash rewards on every purchase, and you have a to pay $0 annual fee while applying for the card.

The benefits for using a Barclaycard cash forward MasterCard are:

No fraud liability, Chip card technology, Free FICO credit score online, and various MasterCard travel card assistance services, which is available for 24 hours a day and 365 days a year. If you face any issues in getting enrolled for this card, you can use this Barclaycard customer service phone number, 08001510900.

Barclay JetBlue Card

If you use the Barclay Jetblue card, you earn 50,000 bonus points and 3 cross points on jet blue purchases. You have to pay no annual fee while applying for the card and you earn 2 cross points at grocery and restaurant.

The benefits for applying this card are:

- You have to face no blackout dates.

- You can redeem any seat at Jetblue Flights.

- Points rewarded to TrueBlue will never expire.

- $0 Fraud Liability Protection

- Family Pooling

- Paying for the purchases is more secure at chip-card terminals.

If you face any issues for this card or in the applying procedure, you can use this Barclaycard customer service phone number, 08001510900.

If you want to apply for a new card, you can use this Barclay card UK phone number,03459454545

Complaints and General Enquiries

Barclaycard strives to provide the best services possible to the clients. Let them know if you face any difficulties in using the services provided by Barclaycard. You can contact the Barclay customer care representatives by phone, fax or be sending a secure message through Barclaycard online servicing.

You can use this Barclaycard customer service number, 08001510900 or 03332009090 to raise a complaint or provide a feedback. The complaint customer services are available for 24 hours a day.

In case, if you do not want to call them, you can also visit their main office at Northampton:

Barclaycard

1234 Pavilion Dr, Northampton NN4 7SG, UK

Contact Barclaycard via Social Media

You can also get in contact with Barclaycard customer services through various social media platforms such as:

With the help of social media channels such as Facebook or Twitter, you can post and message your grievances and get in touch with their clients.

Barclaycard: Balance Transfer for Customers

Are Barclay Card Service providers exhausting you?

Share with us the experience of the Barclay Card customer service like waiting times, courtesy, professionalism, etc. the price of customer retention promotions, and the valuable tips for the benefit of the customers.

Barclays FAQs

- How to register yourself with Barclays Mobile Banking App?

If you have an account with Barclays then follow these steps;

- Download their mobile banking app on your Smartphone

- Open the app and register with your account number and sort code

- Verify your identity using a PINsentry reader or visit at one their cash machines

Registration with your Account Details

Follow the steps listed below to see how to register for the Barclays Mobile Banking with your bank details. You can also visit their branch, and they will help you set up.

Note; this will give you a basic registration which won’t give you access to all the features. But, don’t worry you can always upgrade to full access when it’s convenient later – you will just need to find out an ATM, a branch, or use your PINsentry device.

Before you get started, you will need your debit card.

- Open the app and tap ‘Get Started’

- Then, on the ‘What you’ll need’ confirmation screen tap ‘Continue’

- Here, you will be asked to choose a 5-digit passcode which you will need every time you log in

- Type in your chosen PIN then re-enter to confirm

- Next, tap ‘Enter Your Bank Account Details’ and continue

- Enter and confirm your mobile number

- Then, enter your sort code and account number, your title, first name and last name.

- Make sure all the details are correct before tapping ‘continue’

- Then, read through the terms and conditions and if you are happy with everything tick the box to accept them before confirming your details.

- You will now get a 6-digit verification code sent by SMS to the mobile number you provided.

- Select ‘Continue’ enter the 6 digit verification code, tap ‘verify’ and ‘Continue’

- Select ‘Barclays debit card’ and enter the 3-digit security code for the card number shown on screen.

- Enter the card expiry date. Tap ‘Continue’ and you are done.

Registration Using PINentry

To get full access to Barclays Mobile Banking, register quickly and easily using your PINsentry device.

Before you get started you will need your PINsentry device and your debit card at hand.

- Open the app and tap ‘Get Started’

- Then, on the ‘What you’ll need’ confirmation screen tap ‘Continue’

- Here, you will be asked to choose a 5-digit passcode which you will need every time you log in

- Type in your chosen PIN then re-enter to confirm

- Next, tap ‘Enter Your Bank Account Details’ and continue

- Enter and confirm your mobile number

- Then, enter your sort code and account number, your title, first name and last name.

- Make sure all the details are correct before tapping ‘continue’

- Then, read through the terms and conditions and if you are happy with everything tick the box to accept them before confirming your details.

- You will now get a 6-digit verification code sent by SMS to the mobile number you provided.

- Select ‘Continue’ enter the 6 digit verification code, tap ‘verify’ and ‘Continue’

- Tap on PINsentry card reader’

- Following the 6 steps on your screen, start by entering the last 4-digits of your debit card on your chosen account.

- Insert your card into your PINsentry card reader.

- Presses ‘respond’ on PINsentry card reader.

- Enter the 4-digit PIN number for the card you have inserted.

- Then, enter the unique 8-digit code displayed on your app into the PINsentry reader and enter the unique 8-digit code generated by PINsentry into the app.

- Tap ‘verify’ you will be asked to enter your personal greeting that only you will know.

- Click on ‘continue’ and your registration will be complete.

Note; you must be 16 or over and should have an eligible Barclays product or account to use Barclays Mobile Banking. Terms and conditions apply. Barclays Mobile Banking app only operates with Android 2.3 and above, iOS 5.0 and above or BlackBerry OS 5.0 and beyond. Your service provider may charge for internet access from your phone.

- What is Mobile PINsentry and what is the difference between PINsentry and a card reader?

Mobile PINsentry is a part of the Barclays Mobile Banking app that allows you to log in to Online Banking without having to carry around a card reader or your debit card.

If you put into use the PINsentry feature, you will always require a PINsentry card reader and your debit card to log in via Online Banking.

Mobile PINsentry grants you the same access to online banking as a PINsentry. You can use it as long as you are enrolled in Online Banking and are already using PINsentry. If you are not, you can always upgrade to PINsentry.

How to use Mobile PINsentry

- Select PINsentry

- Choose your option – identify, respond or sign

- Confirm identity

- Enter your 5-digit passcode

- Use your code

Important Information; Mobile PINsentry is a feature of the Barclays Mobile Banking app, and it is only designed for use with Barclays Online Banking. There are currently no functions within the Barclays Mobile Banking app that requires PINsentry authentication. Once you have registered yourself with Barclays Mobile Banking, it could take up to 10 days for Mobile PINsentry to show up in your app.

- Can I practice PINsentry in Online Banking when I’m abroad?

Yes, you can use PINsentry in Online Banking overseas. However, it’s your responsibility to know if using Online Banking is an offence in that country.

- What should I do if I receive an email asking about my Online Banking Details?

You need to ignore this mail; it is expected to be a fraud mail and won’t be from Barclays.

- Why can’t I send gift cards through Pingit anymore?

Pingit stopped offering gift cards at the end of 2016.

- My card has been stolen/lost. What next?

Let them know immediately if you have lost your car or if you think that your card has been stolen. You can do this in several ways; 24 hours and a 7 days a week. They will cancel your card and send a replacement card straightaway – you will be getting it within 2 business days. You need to be very careful and report to them if you find any unusual transactions on your card.

Online

Once you have logged in to Online Banking, choose the ‘Manage accounts’ tab on the top menu and select the ‘Report a lost or stolen debit card’ link in the ‘Card services’ list.

Mobile

You can now notify your card lost or stolen using the Barclays Mobile Banking app by tapping ‘Your cards’ in the ‘Account Management’ section – then selecting the ‘Report card lost or stolen’ option below the image of the card in question.

Telephone

If you want to report your card lost or stolen, you can contact them at 0800 400 100 and if calling from abroad; +44 2476 842 099

- Blue Notch / Picture cards – +44 2476 842 099

- Retail International Clients (BUK) – +44 (0) 162 468 4444

- Wealth Client Services Onshore (BUK) – +44 (0) 207 761 5138

- Wealth Client Services Offshore (BI) – +44 (0) 207 574 3008

- Business Customers 0800 151 0155 and if calling from abroad: +44 2476 842 091

Lines are open 24*7

Branch

You can report your card lost or stolen at any Barclays branch and, if it’s an urgency and you need your card straightaway, they offer an instant debit card replacement service. You can use their branch finder to find your nearest branch that provides this service.

How can I access Barclays Mobile Banking if I my finger is not recognized?

- How can I access Barclays Mobile banking if I my fingerprint is not recognized?

You will get three chances to authenticate using your fingerprint if you have fingerprint enabled access to Braclays Mobile Banking.

Just in case, your fingerprint is not recognized, you will be asked to log in using your 5 digit passcode. However, if your fingerprint continues to be unrecognizable, you may need to add your fingerprint login in your device settings.

- I am registered With the Barclays Mobile Banking App, but I lost my phone.

If you have lost your mobile phone, we recommend you to call them immediately on 03332001014 to disable your Barclays Mobile Banking app. They will cancel the services so; you will have to register again on your new phone.

- How do I switch off fingerprint log in with Barclays Mobile Banking?

If you would like to turn off fingerprint login for Barclays Mobile Banking, go to the app settings, tap on fingerprint login, then push the switch to the off position.

- Why does Barclays Mobile Banking app ask me to make a video call?

You are required to make a video call by logging into Barclays Mobile Banking app so that they can connect you straight to the right person for your account service query.